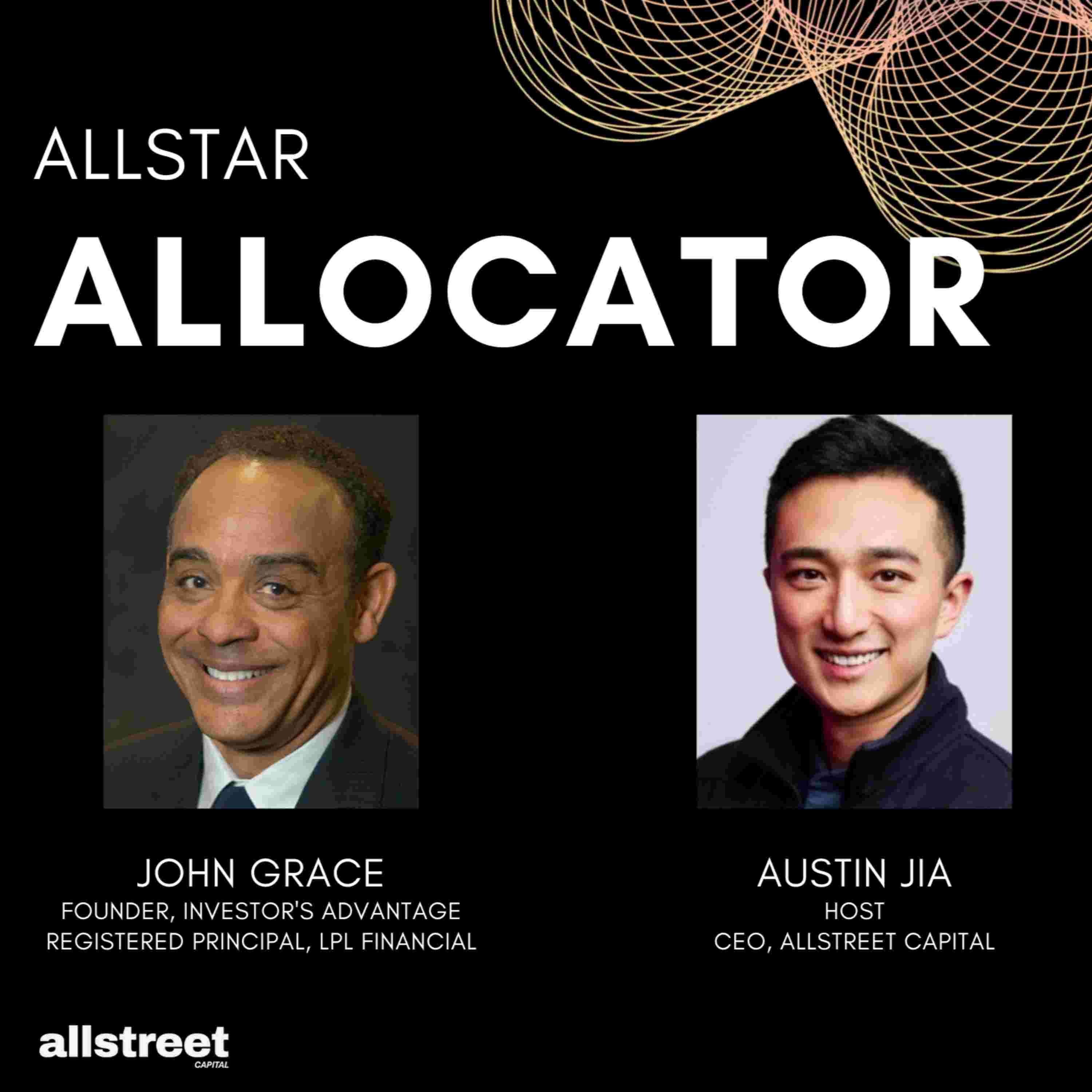

In this episode of the AllStar Allocator podcast, host Austin Jia interviews John Grace, founder and a seasoned wealth manager with over 30 years of experience. They discuss the importance of understanding client relationships, investment strategies, and the impact of market volatility on investor behavior. John emphasizes the need for active management and diversification in portfolios, as well as the significance of evaluating investment opportunities carefully. The conversation also touches on the role of wealth managers in client success, how to choose the right wealth manager, and the future trends in the wealth management industry, particularly the growing interest in alternative investments.

Takeaways:

Chapters:

00:00 Introduction to Wealth Management Insights

02:10 The Journey into Financial Planning

04:43 Understanding Client Risk Tolerance

08:57 Preparing for Market Drawdowns

11:48 Active Management vs. Passive Investment

14:57 Evaluating Investment Opportunities

17:48 Choosing the Right Wealth Manager

19:04 Understanding Withdrawal Rates and Market Fluctuations

19:46 The Value of Agile Investment Advisors

19:59 Success Stories in Capital Management

22:09 Consumer Behavior and Market Trends

25:31 The Future of Real Estate Prices

28:05 Lightning Round: Financial Insights

30:33 The Future of Wealth Management