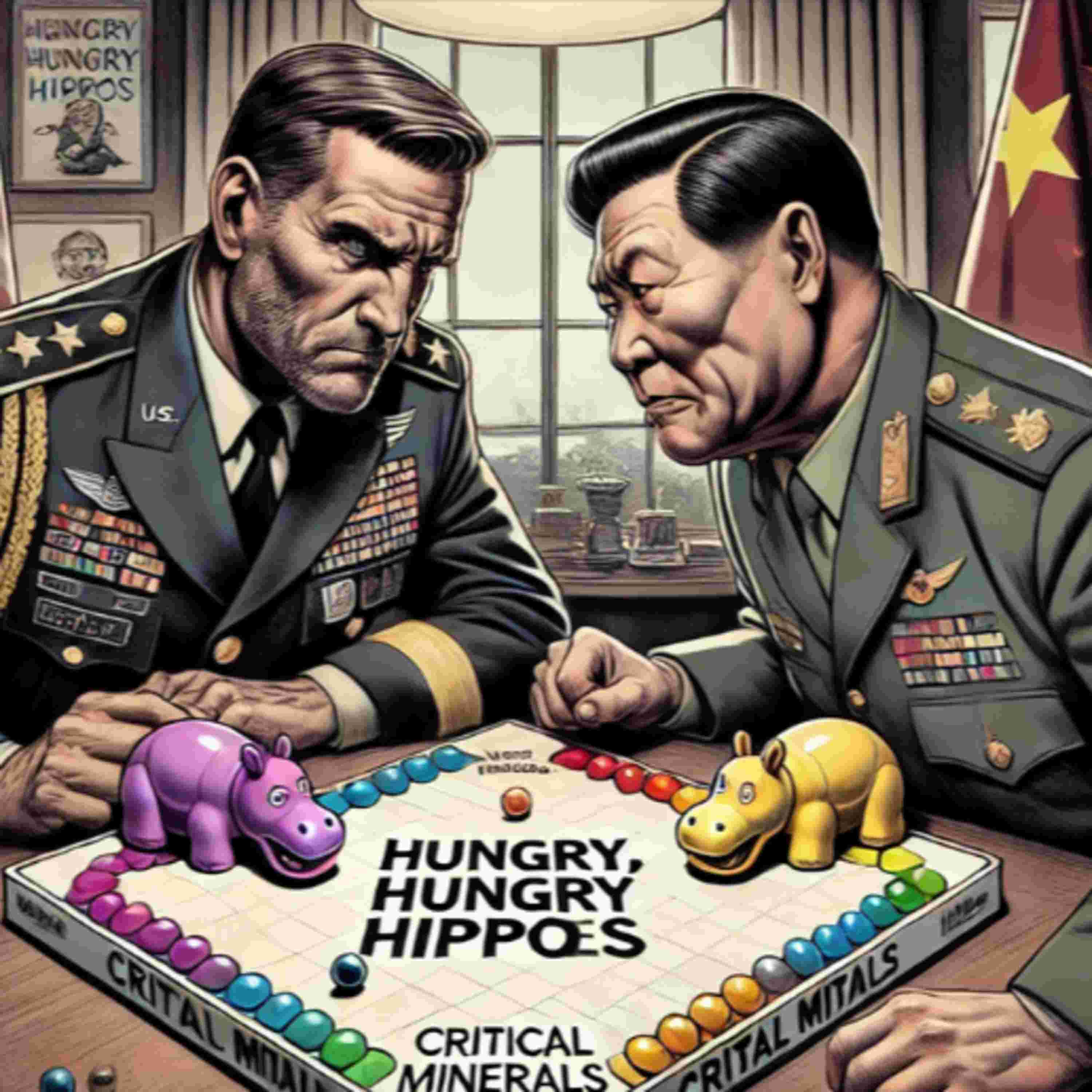

In this conversation, the speaker discusses the ongoing tensions between the US and China, particularly regardingcritical minerals and their impact on the market. The discussion highlights the volatility in equity markets, the role of AI in shaping investment strategies, and the importance of critical minerals in the current economic landscape. The speaker emphasizes the need for investors to focus on sectors that are likely to benefit from these dynamics, particularly in mining and commodities.

takeaways

The US-China relationship is affecting market stability.

Equity markets are experiencing significant volatility.

AI is influencing investment strategies and market dynamics.

Critical minerals are becoming increasingly important in the economy.

Investors should focus on sectors with potential supply deficits.

The healthcare sector is currently underperforming in the market.

Copper and cobalt are critical for future economic needs.

BHP and Rio Tinto may see significant gains if iron ore prices rise.

Investing in critical minerals could yield substantial returns.

Market trends indicate a bullish outlook for certain commodities.